(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

Keep – It – Simple – Stupid = KISS

Many readers forget the principle of KISS when reacting to the policy firehose of US President Donald Trump’s administration. Trump’s media strategic goal is that every day you wake up and say to your friend, partner, or inner self, “Oh My Fuckin God did you see what Trump / Elon / RFK Jr. etc. did yesterday, I can’t believe they did that.” Whether you are emotionally elated or devastated, the melodrama that is “Days of Our Emperor” is entertaining.

For investors, this constant state of arousal is detrimental to stacking sats. One day, you buy and then quickly sell after digesting the next headline. The market chops you in the process, and your stack quickly diminishes.

Remember KISS.

Who is Trump? Trump is a real estate showman. To be successful in real estate, you must master the art of borrowing immense sums of money at the cheapest interest rate possible. Then, to sell units or rent space, you must boast about how impressive the new building or development will be. I’m not interested in Trump’s ability to engender pathos in the global community but in his ability to finance his policy goals.

I am confident that Trump wants to debt finance his America First policies. If that weren’t the case, he would allow the market to naturally extinguish the credit embedded within the system and usher in a depression greater than that of the 1930s. Does Trump want to be known as the 21st century Herbert Hoover, or Franklin Delano Roosevelt (FDR)? American history trashes Hoover because historians believe he didn’t print enough money fast enough and venerates FDR due to his New Deal policies, which were paid for with printed money. I believe Trump wants to be considered the greatest President ever, and as such, he isn’t interested in destroying the fabric of the empire with austerity.

To drive home this point, remember that Hoover’s US Treasury Secretary, Andrew Mellon, uttered the following words as it pertained to dealing with the overleveraged US and global economy after the stock market crash:

"Liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people."

Current US Treasury Secretary Scott Bessent ain’t spittin’ fire like that.

If my opinion is correct that Trump will debt finance America First, how does that inform my view on the future of global risk asset markets, and specifically crypto? To answer that question, I must form an opinion on the likely ways in which Trump can increase the quantity of money/credit (i.e. money printing) and decrease its price (i.e. interest rates). Therefore, I must have a view on how the relationship will evolve between the US Treasury Department, run by Scott Bessent, and the US Federal Reserve, run by Jerome Powell.

KISS the

Who does Bessent and Powell serve? Is it the same person or not?

Bessent was appointed by Trump 2.0, and judging by his past and present interviews, he very much shares the same world view as the Emperor.

Powell was appointed by Trump 1.0, but he is a turncoat traitor. He defected over to the side of the Obamas and Clintons. Powell destroyed the little bit of credibility he had left by enacting a jumbo rate cut of 0.5% in September of 2024. The US economy, which was growing above trend and still contained the embers of inflation, didn’t need a rate cut. But Kamala Harris, the stooge of Obama-Clinton, needed a boost, and Powell did his duty and cut rates. It didn’t pan out as expected, but Powell proclaimed after the Trump victory that he would serve out his term and be steadfast on fighting inflation once more.

When you have a large debt load, a few things happen. First, interest payments consume a large portion of your free cash flow. Second, you are unable to finance additional asset purchases because no one will lend to you, given the high levels of indebtedness. Therefore, you must restructure your debt, which requires extending the maturity and lowering the coupon. It’s a form of soft default because doing both things mathematically lowers the present value of the debt load. You can borrow again at affordable rates once your effective debt load is reduced. Viewing the issue in these terms, the Treasury and the Fed each have a role to play in restoring the financial health of America. Success in this endeavor is hampered due to Bessent and Powell serving different masters.

Debt Restructuring

Bessent has gone on record as saying that America’s current debt profile must change. He wants to eventually lengthen the average maturity of the debt load, which, on Wall Street, is referred to as terming out the debt. Various macro pundits have suggestions on achieving that; I spoke at length about such a solution in “The Genie”. However, the bottom line for investors is that the US will soft default on its debt load by lowering the net present value.

Given the global distribution of US debt holders, achieving this restructuring will take time. It’s a geopolitical Gordian knot. Therefore, it doesn’t concern us crypto inventors in the short term, by which I mean in the next three to six months.

New Loans

Powell and the Fed have extensive control over the quantity of credit and its price. The Fed is legally allowed to print money to buy debt securities, which increases the quantity of money/credit, aka money printing. The Fed also sets short-term interest rates. Given that the US cannot default in nominal dollar terms, the Fed determines the dollar risk-free rate, which is the Effective Federal Funds Rate (EFFR). The Fed has four main levers to manipulate short-term interest rates: the Reverse Repo Program (RRP), Interest on Reserve Balances (IORB), Fed Funds Lower Bound, and Fed Funds Upper Bound. Without getting into the money market plumbing weeds, all we need to understand is that Powell can unilaterally increase the quantity of dollars and lower its price.

If Bessent and Powell served the same master, analyzing the future path of dollar liquidity and the reactions of China, Japan, and the EU to US monetary policy would be very easy. Given that they obviously don’t, I wonder how Trump can maneuver Powell to print money and drop interest rates while still allowing Powell to adhere to the Fed's inflation-fighting mandate.

Tank the Economy

Fed-Recession Law: If the US economy is in a recession or the Fed fears the US economy will enter one, it will cut rates and or print money.

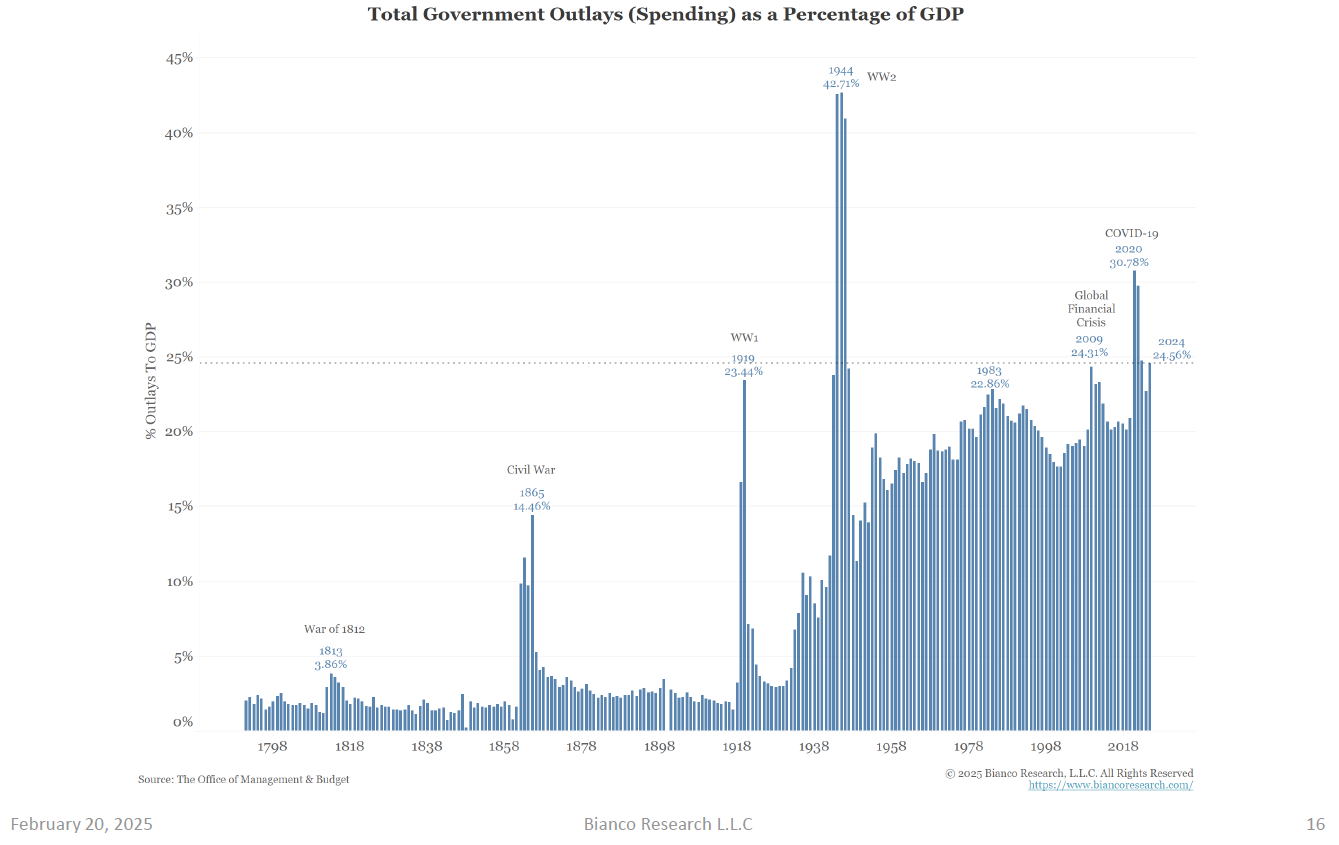

Let’s test this law with recent economic history. Thank you to Bianco Research for this excellent table.

This is a list of the proximate causes of the modern post-WWII US recessions. A recession is defined as negative quarter-on-quarter GDP growth. I will focus specifically on the 1980s until the present.

This is a chart of the Fed Funds Rate lower bound. Each red arrow represents the start of an easing cycle that coincided with a recession. As you can see, it’s very clear that the Fed will, at a minimum, cut rates during a recession.

At a fundamental level, Pax Americana and the global economy it lords over is debt-financed. Large businesses fund the expansion of future production and current operations by issuing debt. If the cash flow growth slows considerably or outright declines, the eventual repayment of the debt is called into question. That is problematic because liabilities for corporations, in large part, are assets for banks. The corporate debt asset held by banks backstops their liabilities of customer deposits. Simply put, if the debt can’t be repaid, it calls into question the “value” of all fiat credit bank notes in existence.

Furthermore, in the US, most households are levered. Their consumption patterns are paid for at the margin with mortgages, auto loans, and personal loans. If their cash flow generation ability slows or declines, they will be unable to meet their debt obligations. Again, the banking system holds said debt and underpins its deposit liabilities.

It is essential that the Fed does not allow mass defaults or a perceived increase in the default probability of corporate and or household debt during a recession or right before the cash flow generation slows or contracts. This leads to corporate and consumer debt defaults, resulting in systemic financial distress. To protect the solvency of the debt-financed economic system, the Fed will proactively or reactively cut rates and print money every time there is a recession or a heightened perceived risk of one.

KISS

Trump maneuvers Powell to ease financial conditions by causing a recession or convincing the market that one is right around the corner. To stave off a financial crisis, Powell will then do some or all of the following: cut rates, end quantitative tightening (QT), restart quantitative easing (QE), and/or suspend the Supplemental Leverage Ratio for banks purchasing US Treasury debt securities.

DOGE This

How does Trump unilaterally cause a recession?

The marginal driver of US economic growth exceptionalism has been the government itself. Whether the spending is fraudulent or necessary, government spending creates economic activity. In addition, there is a money multiplier on government spending. This is why the Washington D.C. metropolitan area is one of the wealthiest in the country, due to the plethora of professional leeches extracting blood from the government. It’s difficult to estimate the exact money multiplier directly, but conceptually, it is easy to understand that government spending has a follow-on effect.

Per Perplexity:

● The median household income in Washington, D.C. is $122,246, much higher than the national median.

● This places Washington, D.C. in the 96th percentile of U.S. cities for household income.

As a former president, Trump knew the level of grift, fraud, and waste within the government. The establishment from both political parties had no interest in taming it because everyone benefitted. Given that Trumpians are outsiders of both the Democrat and Republican parties, they have no issue shining a light on the cockroach-infested government spending programs. The creation of an advisory committee with Trump’s rubber stamp behind it called the memetic Department of Government Efficiency (DOGE), run by Elon Musk, is the central thrust to severely shrink government spending quickly.

How is DOGE doing this when many of the largest spending line items are non-discretionary? If the payment is fraudulent, it can be stopped. If computers can replace the government employees who administer the programs, the human resource cost will decline precipitously. The question then becomes, how much fraud and inefficiency are baked into government spending each year? If DOGE and Trump are to be believed, it is in the trillions of dollars annually.

One potentially flagrant example is to whom the Social Security Administration (SSA) sends checks. If we are to trust DOGE's claims, the department is distributing nearly a trillion dollars to deceased individuals and to those whose identities have not been properly verified. I don’t know the veracity of this assertion. But imagine you are an SSA benefit fraudster and know that Elon and “Big Balls” are deep into the data and could flag fraudulent payments you have received for many years to the Department of Justice. Do you continue your caper or run for the hills? The point is that fraudulent activity might decline due to the mere threat of discovery. As they say in China, 杀鸡儆猴 (killing the chicken to scare the monkey). Therefore, while the establishment media gaslights Elon and DOGE, I’m sure if ain’t a trillion, it’s a few hundred billion.

Moving onto the human resource side of the government spending equation. Trump and DOGE are firing hundreds of thousands of government employees. It is yet to be determined if the unions are strong enough to mount legal challenges to the mass extermination of “useless” government workers. But the consequences are already being felt.

The biggest risk is that the layoffs we have seen so far are just the tip of the iceberg. The magnitude and timing of future layoffs will determine whether the labor market can stay on the rails," DeAntonio explained. "We currently expect that the size of the federal workforce will shrink by about 400,000 throughout 2025 due to a combination of the ongoing hiring freeze, deferred resignations, and DOGE-initiated layoffs.

The effects of DOGE are clear as day, even though the Trump 2.0 presidency is just over a month old. Jobless claims in the D.C. area are spiking. House prices are dumping. And consumer discretionary spending, arguably driven by massive fraud and grift emanating from the US government, is disappointing financial analyst projections. The market is starting to talk about the “R” word.

Home prices in Washington, D.C., have fallen by 11 percent since the beginning of the year, according to a new analysis by real estate trading platform Parcl Labs, tracking the impact of the Department of Government Efficiency's (DOGE) actions on the city's housing market.

– Newsweek

In a post on Bluesky, Rothstein stated that the country is almost certainly heading toward a severe economic contraction due to mass layoffs in government jobs and abrupt federal contract cancellations.

R for Recession is the economic scarlet letter. Powell has no desire to become a modern-day trans Hester Prinn, and therefore, he must respond.

The Powell Pivot - Yet Again

Powell must have whiplash due to how many times he has pivoted since 2018. The question for investors is whether Powell acts proactively to save the financial system from a blow up or reactively once a large financial player goes kaput. The path that Powell chooses is purely political in nature. Therefore, I can’t handicap it.

What I do know is that $2.08 trillion in US corporate debt and $10 trillion in US treasury debt must be rolled over this year. If the US is on the cusp of or in the middle of a recession, the hit to cash flow generation will make rolling over these gargantuan sums of paper almost impossible at the current interest rate level. Therefore, to safeguard the sanctity of the Pax Americana financial system, the Fed must and will act.

For us crypto investors, the question is how fast and how much credit will gush out of the US? Let’s break down the four primary levels the Fed will pull to right the ship.

Cutting Interest Rates

It is estimated that a 0.25% cut in Fed Funds equates to $100 billion of QE or money printing. Let’s assume the Fed cuts rates to 0% from 4.25%.[1] That equates to $1.7 trillion of QE. Powell may not cut rates to 0%, but you can bet Trump will allow Elon to continue slicing and dicing until Powell cuts rates to a desired level. When an acceptable interest rate level has been reached, Trump will reign in his attack dog.

Stop QT

The recently released Fed minutes from the January 2025 meeting detailed that certain board members believed QT must end sometime in 2025. QT is the process by which the Fed reduces the size of its balance sheet, thus reducing the amount of dollar credit. The Fed conducts $60 billion per month of QT. Assuming the Fed swings into action in April, that means for 2025 on a relative basis vs. previous expectations, the cessation of QT will inject $540 billion of liquidity.

Restart QE / SLR Exemption

To soak up the US Treasury supply, the Fed can restart QE and grant banks an SLR exemption. Using QE, the Fed can print money and buy treasuries, thus increasing the quantity of credit. The SLR exemption allows US commercial banks to buy treasuries using infinite leverage, thus increasing the quantity of credit. The point is that both the Fed and the commercial banking system are allowed to create money out of thin air. Both a restart of QE and granting of an SLR exemption are decisions only the Fed is allowed to make.

If the Federal deficit stays in the $1 to $2 trillion per year range, and the Fed or banks soak up half the new supply, that means an increase in the money supply of $500 billion to $1 trillion on an annual basis. 50% participation is conservative because during COVID-19, the Fed purchased 40% of new issuance. Still, in 2025, the large exporters (China) or oil producers (Saudi Arabia) have stopped or dramatically slowed down the buying of treasuries with their dollar surpluses; therefore, the Fed and banks have even more manipulation to conduct.

Total Fed Maths

Rate Cut: $1.7tn

+

QT Stoppage: $0.54tn

+

QE Restart / SLR Exemption: $0.50tn to $1tn

=

Total = $2.74tn to $3.24tn

COVID vs. DOGE Money Printing

In the US alone, the Fed and Treasury created approximately $4 trillion of credit between 2020 and 2022 in response to the Flu-19 pandemic.

The DOGE-inspired money printing could be 70% to 80% of COVID levels.

Bitcoin rose approximately 24x from its lows in 2020 to its highs in 2021 due to $4 trillion of money printing in the US alone. Given that the Bitcoin market cap is much larger now than then, let’s be conservative and call it a 10x rise for $3.24 trillion of money printing in the US alone. For those who ask how we get to $1 million in Bitcoin during the Trump presidency, this is how.

What Must Be True

I’m painting a very rosy future picture for Bitcoin even though the markets are currently in the shitter. Let’s go through my assumptions so readers can decide for themselves whether they are reasonable or not.

Trump will debt-finance America First.

Trump is using DOGE as a way to cull political opponents addicted to fraudulent income streams, curtail government spending, and increase the likelihood of a US government spending slowdown-led recession.

The Fed will respond pre or post-recession with a raft of policies that will increase the quantity and reduce the price of money.

Given your worldview, it’s up to you to determine if this makes sense.

US Strategic Reserve

I woke up Monday morning to a Trump pump. On Truth Social, Trump reiterated that America would create a strategic reserve filled with Bitcoin and a bunch of shitcoins. The market is up sharply on the “news”. This is nothing new, but the market took the reaffirmation of Trump’s crypto policy intentions as an excuse for a violent dead cat bounce.

If this reserve is to affect prices positively, there needs to be an ability for the US government to actually buy these cryptocurrencies. There is no secret pile of dollars just sitting idle waiting for deployment. Trump needs help from Republican legislators to raise the debt limit and/or revalue gold to match the current market price. These are the only two ways to fund a crypto strategic reserve. I’m not saying Trump won’t keep his word, but the time frame on which buying can commence is probably longer than leveraged traders can hold out before liquidation. Therefore, fade this rally.

Trading Tactics

Bitcoin and the broader crypto markets are the only true global free markets left in existence. The price of Bitcoin tells the world in real time what the global community thinks about the current state of fiat liquidity. Bitcoin reached a high of $110,00 on the eve of Trump’s coronation in mid-January and hit a local low of $78,000, a decline of roughly 30%. Bitcoin is screaming that a liquidity crisis is nigh, even though the US stock market indices are still near their all-time highs. I believe the Bitcoin signal, and as such, a severe US stock market correction is on the horizon, driven by recession fears.

If Bitcoin leads the market on the downside, it will also do so on the upside. Given how quickly minor financial disturbances metastasize into full-blown panics due to the enormous amount of leverage embedded within the system, we won’t have to wait long for Fed action if my predictions are generally correct. Bitcoin will bottom first and then start rising as the filthy fiat financial system, led by US stocks, plays catch-up and pukes.

I firmly believe we are still in a bull cycle, and as such, the bottom at worst will be the previous cycle’s all-time high of $70,000. I am not certain whether we will get that low. One positive dollar liquidity signpost is that the US Treasury General Account is declining, which acts as a liquidity injection. Given that I am very confident in my assumptions on the type of financier Trump is and what his ultimate goals are, Maelstrom added risk while Bitcoin traded in the $80,000 to $90,000 range. If this is truly a dead cat bounce, I expect to get another bite at the apple in the low $80,000s. If the S&P 500 and or Nasdaq 100 trades down 20% to 30% from all-time highs coupled with a large financial player teetering on the brink of failure, we could experience a global correlation one moment. That means all risk assets get spanked together, and Bitcoin could trade below $80,000 again and possibly trade down to $70,000. Regardless of what happens, we will be cautiously nibbling on dips using no leverage in anticipation of the final filthy fiat financial market convulsion before the globe, led by the US, can reflate and take Bitcoin to $1,000,000 or higher.

Watch out for China. Xi Jinping wants to keep the yuan stable against the dollar, whether for good or bad. If the dollar supply increases, he can instruct the People’s Bank of China to increase the yuan supply, ensuring the dollar-yuan exchange rate remains stable.

KISS

Let politicians do politician things, stay in your lane, and buy Bitcoin.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

[1] I am still searching for the various economic papers which estimate the impact. I remember a good friend of mine who works for a large bond hedge fund quoting this figure.

Brilliant, as always Arthur, thank you for your erudite yet original and contemporary take on these crazy economic times we are living through. What's your take on Michael Howell's recent piece on "s Trump 2.0 Planning A ‘New’ Gold Exchange Standard?". This is seems to be a more nuanced version of an outright and one time USD devaluation vs Gold, and essentially a pegged system which allows for movement in fiat but caps money supply growth. I'm curious on your take, seems like something they might do and if so where does it leave other monetary debasement hedges such as BTC?

Excelente como siempre . Gracias 🙏